NEWS

Renters are Working for 125 Days a Year to Pay Their Landlords

Renters in England worked for 125 days for their landlords this year. The 5th of May is the first day they start working for themselves

Cost of Rent falls on the 5th of May;

English renters work 125 days of the year solely to pay their landlords;

Cost of Rent Day is the day on which, on average, renters in England earn enough before tax to cover their annual rent bill;

Cost of Rent days have been calculated for 309 local areas, and 9 regions across England;

This analysis of local areas shows Cost of Rent Day is even later in England’s major cities and the South East;

For example, the average Cost of Rent day in London is the 16th July, more than a month later than the national average. This means that higher salaries are not sufficient to compensate for higher rent prices renters face in the capital;

The Adam Smith Institute has also created an interactive tool which allows users to input their gross annual income (before tax) and monthly rent, in order to find out what their personal Cost of Rent Day is;

This research also exposed gaps in ONS housing statistics that need to be addressed to enable better tracking and understanding of the costs of rent;

It is now incumbent on policy makers to fix the housing crisis, in particular, addressing the shortage of supply of homes;

MPs, including a former Secretary of State for Housing, Communities and Local Government, and two other former Cabinet Ministers, have provided comments in support of Cost of Rent Day, recognising the need to reduce the burden upon renters, particularly younger people.

Cost of Rent Day is a brand new initiative from the Adam Smith Institute (ASI). It is the day on which renters in England stop paying rent and start putting their earnings into their own pocket. The ASI has estimated that every penny that, on average, renters earned before tax for working before and including May 4th went to their landlord- from May 5th they are finally earning for themselves.

The ASI has created this measure in order to translate the severity of the housing and rental crisis into simple terms that can be easily understood by all audiences. It provides a useful measure to hold politicians to account and track changes over time.

To calculate the Cost of Rent Day, annual rents were divided by gross annual pay, to understand what proportion of earnings are spent on rent. Cost of Rent Days were calculated for 309 local areas across 9 regions across England, and the ASI has also created an interactive tool which allows renters to easily find out what their personal Cost of Rent day is.

As the ASI outlines, the root problem is the lack of supply. Since the 70s, England’s construction of new homes has lagged behind population growth. In other words, new demand has outstripped supply.

Directly punishing all landlords or introducing policies such as rent controls will only make the situation worse for renters. Instead, politicians must focus on creating the right incentives for developers and landlords, and on increasing supply.

The ASI has previously outlined a number of solutions, which it calls on the government to consider. These include using compulsory purchase orders to buy, and develop on metropolitan green belt land, and give local residents a share of the profit, releasing all green belt land within a ten minute’s walk of a railway station for development, and extending ‘full expensing’ to brownfield sites.

James Lawson, Chairman of the Adam Smith Institute and author of this report, said:

“Across the country, the cost of renting is simply too high. Our new analysis exposes just how severe the crisis is across England and that it is even worse in our cities, London, and the South East.

England’s housing market is not operating as a free market - the UK is shackled by regulations and an incentive structure that empower NIMBYs.

Many of the policies which are being widely touted as solutions, including rent controls and punishing landlords, will only make things worse. We must liberalise our planning system to address the lack of supply. We must boost productivity and wage growth, so pay packets increase too.

In the midst of a cost of living crisis, and nearly two decades of stagnation, ‘Cost of Rent Day’ is another damning indictment on the performance of the British economy. It must be fixed with renewed vigour.”

The Rt Hon Robert Jenrick, Member of Parliament for Newark and former Secretary of State for Housing, Communities and Local Government, said:

“This is a stark reminder to the Westminster bubble of just how distorted and unaffordable the rental market has become. We are at a crisis point where living standards are falling and younger generations are unable to save.

The solution is blindingly obvious. We need to build significantly more homes, particularly in London, to boost supply and we urgently need to cut net migration to the historical norms of 10,000s to ease demand.”

The Rt Hon Sir Brandon Lewis CBE, Member of Parliament for Great Yarmouth and Patron of the Adam Smith Institute said:

“The Housing Crisis is one of the single greatest issues facing the UK. High-skilled professionals are being priced out of our most productive towns and cities, young couples may feel unable to afford to have another child, and sky-high rents are eating into workers’ pay packets.

This new and engaging initiative by the Adam Smith Institute throws these problems into stark relief.

Conservatives should be genuinely concerned that the average worker in England today is spending nearly half a year earning enough money just to pay for their rental costs- and that’s before taxation.

It’s no wonder our young people are unable to save to get onto the property ladder. If the Conservative party wants to continue to call itself the party of homeownership, it is absolutely imperative that we make increasing housing supply a key plank of our next manifesto.”

The Rt Hon Dame Priti Patel DBE, Member of Parliament for Witham said:

“Rental costs are becoming increasingly unaffordable for many. We need to see a return to a property-owning democracy with new measures brought in to boost housing supply and help more people get their first steps on the property ladder. When more people are able to own their homes they have a strong stake in the community they live in and the security that comes with owning an asset.”

Paul Scully, Member of Parliament for Sutton and Cheam, said:

“Cost of Rent Day’ is a stark reminder of the heavy financial burden that many people in England face today as a result of sky-high rental costs, including in Sutton where renters are working for longer than the national average to pay off their annual rent bill. It is a worrying state of affairs that higher wages in London are not compensating for higher rents.

The consequences of any failure to address the root causes of this issue are existential. As young people increasingly feel as though their hard work goes unrewarded, they will lose faith in markets. And if we fail to empathise with their struggles, we risk an entire generation turning their back on the Conservatives for years to come.”

Councillor Promise Knight, Labour Cabinet Lead Member for Housing, Homelessness and Renters Security at Brent Council said:

“There are close to 5 million renters in our capital, and for many Londoners renting is a flexible, high-quality option- and a place from which to build a new beginning and try out our city for every prospect it offers.

For a greater proportion still, renting is not a choice made freely, but the result of an overcooked housing market that squeezes out Londoners on lower or middle incomes and is draining our city of the key workers it needs to survive.

Today’s research from the ASI shows exactly what many of us know already, far too many Londoners are working only to pay their rent.

In Brent, we have over 32,838 residents on our housing waiting list, with thousands of renters added each year through no-fault evictions by landlords. We are building more homes than ever before, introducing landlord licensing to enforce against scrupulous profiteers, but it does not change the fundamentals- the housing market in London is broken and we need to sit up and take action.

Freddie Poser, Director of PricedOut, said:

“Cost of Rent Day shows just how much time renters spend working just to have a roof over their heads. Yet again it highlights the incredible burden the housing crisis places on young people, a burden that can only be lifted by building more homes.”

-ENDS-

METHODOLOGY:

To calculate the Cost of Rent Day monthly rents were converted into an annual figure. Then annual rents were divided by gross annual pay, to understand what proportion of earnings are spent on rent.

To balance for leap years and support better inter-year comparisons, a year is treated as being 365.25 days long.

Using otherwise unrounded inputs, this calculation implied 125 days of the year are spent on rent. The 126th day of the year is May 5th.

The ASI used annual gross pay (before fiscal deductions / taxes) to generate these calculations.

This is a deliberately simple calculation and as outlined above and below, will not capture the nuances of individual circumstances. However, it enables a simple, transparent, and intuitive calculation - this is preferable to more complex alternatives we developed.

To produce this analysis, the ASI used two readily available ONS data sources. The analysis is based on the average rent, across all types of rental. The data is broken down by rental type, including a ‘room’, ‘studio’, ‘one bedroom’, ‘two bedrooms’, ‘three bedrooms’ and ‘four or more bedrooms’ properties but this is not used in the headline calculation.

Regional analysis is based on ONS data and segments England into: East, East Midlands, London, North East, North West, South East South West, West Midlands and Yorkshire and The Humber.

The two data sets have common Area Codes, enabling the analysis across the 309 local areas and 9 regions, both data sets have in common, and where there are values.

The Median was used by default for both data sets. When a series of numbers are arranged by order of magnitude the median represents the middle value. The median was chosen instead of the mean, because the data sets are skewed and have outliers.

Notes to editors:

For further comment, or to arrange an interview, please contact emily@adamsmith.org | +44 7584778207

The report and the interactive tool will be available on the ASI website from 10pm Saturday 4th May.

James Lawson is Chairman of the Adam Smith Institute. He led on the creation of Cost of Rent Day.

Sarah Gall created the interactive tools using d3.js. She provides data strategy and analysis services through Sarah C Gall Ltd.

The Adam Smith Institute is one of the world’s leading think tanks. It is ranked first in the world among independent think tanks and as the best domestic and international economic policy think tank in the UK by the University of Pennsylvania. Independent, non-profit and non-partisan, the Institute is at the forefront of making the case for free markets and a free society, through education, research, publishing, and media outreach.

Slash Tax and Scrap the Night Tsar's Salary to Save London's Nightlife

Leading UK think-tank calls for cuts to VAT and beer duty, the expansion of the night-tube and for the paid position of ‘Night Czar’ to be scrapped in order to boost London’s hospitality sector

London’s nightlife is in crisis. Over 3,000 venues have already closed their doors since the start of the pandemic, and punters are finding it almost impossible to simply get a pint after 11pm in the centre of our capital;

A new paper from the Adam Smith Institute (ASI) shows that this decline is not inevitable;

In the run-up to the local elections on the 2nd May, improving London’s nightlife should be a major focus for London Mayoral candidates, especially when appealing to younger voters;

The ASI outlines a number of recommendations which, taken together, would make it safer, easier and cheaper to enjoy a night out in London, whilst supporting our hospitality sector;

These include reducing burdensome costs on the hospitality sector, including VAT and beer duty, preventing local planning puritanism, and extending the night-tube;

The ASI also calls for the £117,000 salary to be removed from the ‘London Night Czar,’ and for it to become an unpaid advisory position given to an industry expert, as it is in Greater Manchester.

London’s famous pubs, restaurants and theatres have attracted tourists and young professionals to the capital for centuries, and now generates £46 billion a year in the process.

But as a new paper from the Adam Smith Institute (ASI) highlights, today its hospitality sector is in crisis. Over 3,000 venues, including much-loved institutions such as G-A-Y and Printworks, have closed since the pandemic, and the average pub’s profit now stands at a net margin of 3%, meaning that many are only just making enough money to stay open.

The sector is being stifled by sky-high operating costs and taxation, from increasing rents and business rates, to VAT, beer duty and local alcohol levies that some councils are imposing on top. And pubs and bars are being constrained by restrictive opening hours and limits on al fresco dining- often at the behest of a vocal minority of residents.

But decline is not inevitable. Politicians in local councils, in City Hall and in Westminster can reduce the burdens on the hospitality sector, and make it easier, cheaper and safer for all of us to enjoy a good night out.

The ASI’s recommendations include:

Reduce sky-high costs for the hospitality sector

VAT should be cut from 20% to 12.5%, helping businesses to stay afloat and to cut costs for consumers, as a similar policy has achieved in Lisbon;

Beer duty should be slashed. Only around 7.5% of the price of a pint is kept as profit. A cut would ensure that a higher proportion would contribute to the long-term health of our beloved British pubs;

Freeze, and in the long-term scrap, local alcohol levies. Currently some councils impose a late-night levy on establishments serving alcohol after midnight, on top of the duty and taxes they already pay.

2. Prevent local planning puritanism

Ensure that principle that already exists under UK planning law is enforced. Under the ‘agent of change’ principle, existing businesses should not have unreasonable restrictions placed on them as a result of new developments;

But too often, residents in new developments are filing noise complaints against existing venues, which leads to councils unfairly amending operating licences;

Ministers should conduct a review of restrictive planning and licensing rules in the city.

3. Expand night-time London transport provision

Provision of the Night Tube and late-night National Rail Services should be expanded. Currently, the Night Tube only covers 5 out of the 11 lines and does not run on Thursdays- the new Friday for many working professionals. Improving its coverage would help revellers get home safely- particularly women;

Increase police presence at stations;

Intervene to stop the harmful taxi tax. The imposition of VAT on private hire vehicles and taxis would make safe ways of getting home more expensive.

4. Learn from Greater Manchester, which is known for its thriving nightlife

Deliver better money for taxpayers by making the ‘London night czar’ an unpaid advisory role, filled by an industry expert;

Learn from Greater Manchester’s more permissive attitude towards regulation.

The Rt Hon. Robert Jenrick, Member of Parliament for Newark and Bingham, said:

“London’s night-time economy is a huge national asset. But it has been increasingly stifled over the past few years by red tape and soaring operating costs, a problem which has been exacerbated by the Mayor of London, his overpaid and hapless night czar, and overzealous local councils.

So I’m delighted to welcome the Adam Smith Institute’s recommendations, which will make it safer, cheaper and easier for punters to enjoy a pint, and will reduce burdensome costs on our pubs, bars and restaurants.

By taking the liberalising approach they outline, we can show that we care about our hard-working young professionals, who deserve to enjoy themselves in a truly 24 hour city.”

Sam Bidwell, Director of the Next Generation Centre and report co-author said:

“Aside from the professional opportunities that the Capital affords, London’s famous nightlife scene is one of the main draws for working-age people. In an age of sky-high rents, it’s more important than ever to ensure that this great city delivers value for money - including by ensuring that its nightlife remains thriving and vibrant.

The example of Greater Manchester shows that the decline of London’s nightlife is not inevitable. By reducing costs for the hospitality sector, slashing cumbersome red tape around planning and licensing, and expanding public transport provision, we can deliver the thriving nightlife offering that London’s young people deserve.”

-ENDS-

Notes to editors:

For further comment, or to arrange an interview, please contact emily@adamsmith.org | +44 7584778207

Sam Bidwell is the Director of the Adam Smith Institute’s Next Generation Centre. He has worked as a Parliamentary Researcher, and as a Press and Research Consultant for the Commonwealth Enterprise and Investment Council. He is a graduate of the University of Cambridge where he specialised in public law, jurisprudence, and legal history.

Mimi Yates is the Director of Engagement and Operations at the Adam Smith Institute. She holds a first class degree in Philosophy from the University of Exeter and has formerly worked for Geneva Micro Labs, and led a non-profit organisation that focuses on street safety for women.

The Next Generation Centre is the Adam Smith Institute's policy initiative, which proposes bold new ideas, by young people and for young people. Alongside building on the ASI's existing body of work on how and why our current economic model is failing for young people, the Centre commissions research from 'Next Generation' fellows, building lasting relationships with the policy-makers of the future.

The Adam Smith Institute is a free market think tank based in London. It advocates classically liberal public policies to create a richer, freer world.

Charles White-Thomson Joins Adam Smith Institute as Senior Fellow

Former Saxo UK CEO Charles White-Thomson, has joined the Adam Smith Institute (ASI), one of the world’s leading domestic economic policy think tanks, as a Senior Fellow.

Charles brings thirty years of financial experience to the ASI. He has worked in a number of senior roles in some of the most volatile and regulated markets in the world. Most recently, he was the CEO and SMF1 of Saxo UK, a multi-asset online trading company, where he was well known for his bold views on UK monetary policy and the economy. His previous experience includes 4 years in Moscow which included the Global Financial Crisis, where he was responsible for Credit Suisse’s equity business in Russia.

The Adam Smith Institute is an independent, non-partisan think-tank, ranked as the top independent think-tank in the world by the University of Pennsylvania. It works to promote free market economics through research, publishing, media outreach and education, and prides itself on putting forward bold and radical policy ideas to deliver real change.

The Institute is famous for its pioneering work over the last decades on privatisation, deregulation, monetary reform (including floating exchange rates and Bank of England independence), its advocacy of internal markets in healthcare and education, and tax reform, including substantial cuts to rates of income tax. It continues to influence public policy today, including the government’s recent adoption of ‘full expensing’ on capital investment.

Commenting on his appointment, Charles White-Thomson, Senior Fellow at the Adam Smith Institute, said:

‘I have long been an admirer of the Adam Smith Institute, with their rich history, clarity of thought, incisive opinions and courage to back their convictions. The United Kingdom has a broad range of opportunities and challenges. More than ever, now is the time for organisations such as the Adam Smith Institute to make their collective voice heard, to drive and encourage debate around the key topics, that will allow the UK to deliver on their full potential and the upside this will bring for the generations of today and those to follow. I look forward to supporting James and the broader team to deliver on this shared ambition.’

James Lawson, Chairman of the Adam Smith Institute, said:

“We’re delighted to welcome Charles onboard as a Senior Fellow. His deep experience in financial markets will prove invaluable as the UK seeks to grapple with the profound economic challenges it faces: the highest tax burden in decades, rising government debt, stagnating productivity, and over a decade without meaningful economic growth.”

-ENDS-

Notes to editors:

For further comment, or to arrange an interview, please contact emily@adamsmith.org | 0758 477 8207

The ASI’s previous work on banking and financial markets has included- but is not limited to- the inadequacy of the UK’s banking system’s stress tests, modern monetary theory, demonitisation, and free banking.

Find out more here about the Adam Smith Institute' research on banking and financial markets.

The Adam Smith Institute is one of the world’s leading think tanks. It is ranked first in the world among independent think tanks and as the best domestic and international economic policy think tank in the UK by the University of Pennsylvania. Independent, non-profit and non-partisan, the Institute is at the forefront of making the case for free markets and a free society, through education, research, publishing, and media outreach.

Applying VAT to Independent School Fees Could Cost As Much As £1.6 Billion

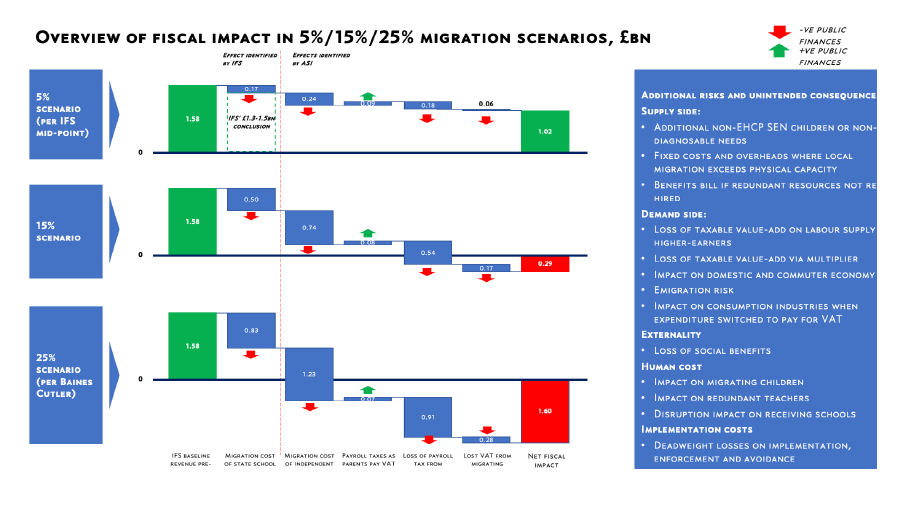

A leading think-tank has warned that applying VAT to independent school fees could actually cost, rather than raise, money, and harm underprivileged children.

A new report by the Adam Smith Institute finds that applying VAT on independent school fees could raise no money at all;

In a less optimistic scenario, it could end up costing £1.6 billion;

The report also finds that the policy could counter-intuitively harm other children by creating a mass exodus to the already overwhelmed state system, intensifying competition for the country’s best state and grammar schools;

It could also reduce bursary and scholarship opportunities for talented youngsters.

A new report by the Adam Smith Institute (ASI) highlights that the IFS’ findings that applying VAT to independent school fees will raise £1.3-£1.5 billion is based on evidence they themselves acknowledge to be ‘thin’ and ‘sparse.’ Under the IFS’ optimistic scenario, only a limited number of parents will no longer be able to afford fees, and will move their children to the state sector.

But the ASI’s research shows that there’s a reasonable chance that many more children will have to migrate to state school.

The report’s author, Maxwell Marlow, has calculated that every parent who earns money, pays tax at a 40% rate, and sends their child to an independent school, generates £28,000 every year for the Exchequer.

On the other hand, if VAT were to be applied, it could actually end up costing money. The ASI’s report looked at many different economic effects that the tax could have, including schools closing down, and teachers and parents leaving the workforce. It found that, in the IFS’ highly optimistic scenario in which 3-7% of children left for the state sector, it could raise a net £1.02 billion. Somewhere between 10-15%, it could raise no money at all. In a 25% migration scenario, which other research has shown may be a possible outcome, it could actually cost the Exchequer £1.6 billion.

The Adam Smith Institute outlines a number of other damaging consequences levying VAT on school fees could have for society and the economy including:

State schools could be even more overwhelmed - We do not know, and cannot know, where exactly in the country children will be leaving for the state sector. There are significant concerns about the ability of local authorities and schools to plan for these unpredictable outcomes.

Teachers and support staff could lose their jobs- 71% of school fees are spent on staff costs- if schools have to make cuts, they will most likely have to make staff redundant or cut their pay. Under the IFS’ optimistic scenario where 5% of children migrate to the state sector, we could (for example) expect 5,150 teachers to be made redundant.

It could counterintuitively have a negative effect on social mobility- If lots of children are financially pushed out of their independent schools, this could intensify competition for the country’s best state and grammar schools, reduce opportunities for talented and less-well off pupils, and drive up local house prices near these schools. If independent schools have to cut costs, this could mean that they reduce bursary and scholarship opportunities.

The ASI further notes that, in 2015, Greece applied a 23% VAT charge on independent school fees. Many of the things the ASI warns about in its paper actually happened- schools closed, teachers were made redundant, and the state sector was overwhelmed and faced huge teacher shortages.

Maxwell Marlow, Director of Research at the Adam Smith Institute, and report author, said:

“Britain's independent schools are good for the economy- taxpaying parents who send their children to one are removing extra costs and burdens from the state sector, and are contributing to public finances.

But applying VAT to school fees puts all this at risk, and counter-intuitively may not raise any money at all. In fact, this might actually cost taxpayers.

Our new report shows that, not only is there a chance it won’t raise money for state schools, it could harm underprivileged children by further over-whelming the already struggling state sector, reducing bursary and scholarship opportunities for talented youngsters, and pushing others out of popular state and grammar schools. And we risk staff redundancies and the closure of small, local independent schools who cannot absorb the costs.

Greece is already suffering the numerous economic and social consequences of applying VAT to school fees we warn about in this paper. We urge policymakers to exercise caution."

-ENDS-

Notes to editors:

For further comments or to arrange an interview, contact Emily Fielder, emily@adamsmith.org | 0758 477 8207.

Maxwell Marlow is the Director of Research at the Adam Smith Institute.

The Adam Smith Institute is a free market think tank based in London. It advocates classically liberal public policies to create a richer, freer world.

Crypto CEO joins the Adam Smith Institute to head up their new Future Markets Policy Unit

Oliver Linch will join ASI Senior Fellows to promote the UK’s thinking in Fintech, AI and Emerging Technologies

The Adam Smith Institute, one of the world’s leading domestic policy think tanks, has launched a new Policy Unit to build on its leading work on the technologies of the future.

Former financial regulatory lawyer and Bittrex Global CEO Oliver Linch will be leading the ASI’s new policy division as a Senior Consultant. He brings a wealth of experience and expertise, having advised major investment banks, exchanges and leading institutions on regulatory matters across the UK, EMEA and North America.

He is a strong advocate of exploring the overlap between traditional finance and fintech — especially digital assets — and the way that they can work together to bring the lessons of substantive and comprehensive regulation into these exciting new sectors.

Oliver will be working alongside existing ASI Senior Fellows, digital policy and strategy consultant Dominique Lanzaksi, senior technology lawyer Preston J. Byrne, and US hedge fund co-founder Vuk Vukovic.

The ASI’s previous work in the fintech, artificial intelligence and emerging technologies policy space has included making the case for gene editing; an optimistic outlook on the future of AI and employment; a system of property rights on the moon, and the UK’s regulation of cryptocurrency.

James Lawson, Chairman of the Adam Smith Institute, said:

“The Adam Smith Institute has long been at the forefront of research into future markets and new technologies, including in health, transport, finance, and the very way we work - and how it can make our everyday lives better.

This new policy unit, with its combined decades of experience, will build on our existing body of research, promoting a positive and evidence-led approach in order to help the UK’s finance industry, public services, and private sector become more innovative, dynamic and effective.

I’m delighted to welcome Oliver Linch to the team as our Senior Consultant, whose phenomenal expertise will be of great value as he leads this important work.”

Commenting on his appointment, Oliver Linch, Senior Consultant to the Adam Smith Institute, added:

“Having long been called upon by colleagues, peers, and the media regarding matters of legal and regulatory policy across the fintech and emerging technologies space, I am delighted to be putting my expertise into practice at the ASI. Together, we aim to transform the way that the UK government thinks about some of the most innovative technologies currently at our disposal — everything from crypto to artificial intelligence. The UK currently stands at the forefront of the emerging technology landscape and, in this role, I hope to shape what the legislation around these innovations looks like.”

-ENDS-

For further comment on this release, or for expert comment from members of our Future Markets Policy Unit, please contact emily@adamsmith.org | 0758 477 8207.

Oliver Linch began his legal career with a leading global law firm, after which he became Chief Executive Officer and General Counsel of Bittrex Global, the global cryptocurrency exchange. He has over a decade of experience as a financial regulatory lawyer, having advised major investment banks, exchanges, and leading institutions on regulatory matters across the UK, EMEA, and North America. As part of one of the world’s top-ranking law firms, he specialised in various areas of financial regulatory advisory work, such as financial market infrastructure, payment services, and special economic zone and legislative drafting.

Dominique Lazanski is a digital policy and strategy freelance consultant, and has spent many years working in the Internet industry with many of those years working in Silicon Valley. She holds degrees from Cornell University and the London School of Economics and PHD from the University of Bath. She is a postdoctoral fellow at the University of Pittsburgh.

Preston J Byrne is a dual-qualified US and English Lawyer, partner with the digital commerce group in the Washington D.C. office of an international law firm and an adjunct professor of law at Antonin Scalia Law School at George Mason University. Preston writes on a range of subjects including housing and planning law, the security state, freedom of expression and cryptocurrency. He was the lead author of ‘Burning Down the House,’ the ASI’s policy paper opposing the Help to Buy mortgage subsidy programme, and is the author of ‘Sense and Sensitivity: Restoring Free Speech in the United Kingdom,’ a proposal for the repeal of numerous censorial law in the United Kingdom.

Vuk Vukovic is the Chief Investment Officer and co-founder of Oraclum Capital, a U.S. hedge fund. He was previously a lecturer at the Department of Economics, Zagreb School of Economics and Management. He holds a PHD in Political Economy from the University of Oxford, a Master’s degree from the London School of Economics and a BA in economics from the University of Zagreb, from which he graduated Magna Cum Laude. He authored the ASI report ‘Unburdening Enterprise: Reducing Regulation for Small and Medium Businesses.’

The Adam Smith Institute responds to the Spring Budget

Commenting on the Spring budget, Director of Research of the Adam Smith Institute, Maxwell Marlow, said:

“It’s encouraging that the Government understands the overwhelming need to cut taxes from the current record high, and the benefits that doing so brings to individuals, families and businesses. The Adam Smith Institute welcomes the cut to National Insurance, as well as the Chancellor’s commitment to even greater tax cuts in the future. Ideally, these would be both soon and include the abolition of entire taxes, like the immoral death tax, and even scrapping National Insurance itself. This would end the farce of double taxation on income by merging income tax and National Insurance for good.

“It’s also good to hear the Treasury has been listening to the Adam Smith Institute’s calls to further broaden full expensing to leased equipment, such as vans, diggers, and the kit we use to build Britain.

“The move towards working out child benefits by households, rather than by individuals, will end an unfair penalty on parents, and make it easier for Brits to have the number of children they want. In the meantime, raising the childcare threshold support to £80,000 is a good stop-gap.

“The planned public sector productivity drive for the NHS, especially by embracing AI, is going to be transformational, but it should be extended across the entire public sector.

“To really unlock the United Kingdom’s potential, the Government must now turn to serious supply side reforms, most importantly by allowing new houses to be built for current and future generations, giving the families of the future a place to call their own.”

-ENDS-

Notes to editors:

For further comment, or to arrange an interview, please contact emily@adamsmith.org | +44 7584778207

The Adam Smith Institute is a free market think tank based in London. It advocates classically liberal public policies to create a richer, freer world.

Adam Smith Institute Launches the Next Generation Centre

Leading UK think-tank will tonight launch a new policy initiative aimed at increasing economic opportunities for Britain’s young people

The Adam Smith Institute (ASI) is launching the Next Generation Centre - a new policy initiative which will be proposing bold new ideas, by young people and for young people - at an event tonight in Westminster.

Economic Secretary to the Treasury, Bim Afolami MP will be joining the Centre as a Patron, and will be making the keynote speech at tonight’s launch event.

The Centre will be commissioning research from new ‘Next Generation’ fellows, building lasting relationships with the policy-makers of the future, while also building on the ASI’s existing body of work on how and why our current economic model is failing to deliver for young people.

In an accompanying paper, new Director of the Next Generation Centre, Sam Bidwell, outlines the six ways in which young people in Britain today are facing worse economic outcomes than their parents and grandparents; including housing affordability, renting costs, tax, higher education and professional prospects, family formation, and the ability to save for the future.

As this new report highlights, the economic challenges facing young people are directly responsible for their increasing disillusionment with our political system, markets and even liberal democracy itself. But with the right ideas, we can re-engage young people by allowing their natural dynamism to flourish.

Commenting on his new role as Patron of the Next Generation Centre, Bim Afolami MP said:

“The Adam Smith Institute has a rich history of putting forward bold new ideas to improve the lives of Britain’s young people, and so I’m delighted to be supporting their Next Generation Centre as a Patron.

The Conservatives have always understood that young people are inherently ambitious and entrepreneurial, and that it is our historic duty to help them realise their goals in life. I am sure that this initiative will complement the work that the Government is doing to deliver greater opportunities for young people.”

Commenting on the launch of the Next Generation Centre, its Director Sam Bidwell said:

“Up and down the country, young people increasingly feel that the economic status quo isn’t delivering for them. Whether it be because extortionate housing and renting costs are denying them the opportunity of owning their own home, or because higher education no longer meets their needs, they are turning away from the ideas and institutions that made Britain so successful.

But it doesn’t have to be this way- liberal democracy and free markets have in the past delivered enormous prosperity, and they can do so again. This will require more than tinkering at the margins; addressing the intergenerational gap will require a fundamental reconfiguration of how we think about our economy.

We at the Next Generation Centre look forward to working constructively with the Government and all those across politics who want to increase opportunities for our young people.”

-ENDS-

Notes to editors:

Bim Afolami MP has joined the Next Generation Centre as a Patron. He will be supporting the Centre’s ambition to deliver greater opportunities for young people through bold, market-orientated ideas.

As Patron, he will be supporting the aims of the Centre, but his role does not constitute a formal endorsement of all of the Centre’s proposals.

Sam Bidwell is the Director of the Next Generation Centre. He has worked as a Parliamentary Researcher, and as a Press and Research Consultant for the Commonwealth Enterprise and Investment Council. He is a graduate of the University of Cambridge where he specialised in public law, jurisprudence, and legal history.

The Adam Smith Institute is a free market think tank based in London. It advocates classically liberal public policies to create a richer, freer world.

The ASI Calls for Inheritance Tax to be Scrapped

Leading think-tank’s paper on abolishing inheritance tax, building on arguments it first made nearly 30 years ago, shows that the economic case for abolishing inheritance tax is even stronger

A new paper from the Adam Smith Institute revisits the case for scrapping Inheritance Tax (IHT) that it first made in 1995, and finds that the same arguments are just as strong today and, in some cases, are even more so.

The ASI outlines the following economic reasons to abolish IHT:

It places an unfair burden on those liable to pay the tax, often when their relatives are in the midst of grieving the death of a loved one. The responsibility to pay the right amount in tax falls entirely on the executor of the deceased’s will, often at great administrative expense. The pages of forms that have to be filled in have quintupled from 23 to 118 since 1995.

Family businesses are more likely to go bust, and it discourages individual ownership of shares. This is because shareholders in ‘quoted companies’ - those large enough to be floated on the stock market- are able to sell their shares. But shareholders in much smaller ‘unquoted companies,’ often family-run small businesses, are far less likely to have enough money, so the charge falls onto the company instead. This weakens the company financially and means that it's either more likely to go bust or be taken over.

The way the tax is structured encourages individuals to invest their money into less productive areas of the economy, rather than investing in companies and capital.

All of these negative impacts are due to a tax which is making up increasingly less of the total tax take. In 1992/3, it was 1.7%, and in 2022 it was a mere 0.89%. And it’s costing the Exchequer £26.3 billion in exemptions and carve-outs; far more than the tax actually raises.

The Rt Hon Nadhim Zahawi, Member of Parliament of Stratford-upon-Avon and Patron of the Adam Smith Institute said:

“Conservatives have long understood that the continued existence of inheritance tax is fundamentally antithetical to our instincts. It is levied disproportionately on the most entrepreneurial parts of our economy, it complicates our already over-burdensome tax code, and it prevents us from fulfilling the most basic human desire of all; to leave our children better off than we were ourselves.

This newly updated report by the Adam Smith Institute highlights how the moral and economic arguments in favour of the abolition of inheritance tax that they were making almost 30 years ago are just as compelling today.

The Government has the opportunity in the Spring Budget to demonstrate our Conservative values; that we understand that individuals know best what to do with their own money and that we are on the side of family-run businesses. One of the most effective ways to do so would be to abolish the immoral death tax.”

Maxwell Marlow, Director of Research at the Adam Smith Institute, said:

“The Adam Smith Institute has been outlining the numerous reasons to rid the UK of this distortionary tax for decades.

With fiscal drag now pulling more and more people into paying, there can be no more appropriate time to properly consider the negative impacts that inheritance tax has, and the benefits of scrapping it.”

ENDS

Notes to editors:

For further comments or to arrange an interview, contact Emily Fielder, emily@adamsmith.org | 0758 477 8207.

Barry Bracewell-Miles (1931-2021), author of the original paper, authored six papers for the ASI, ranging from inheritance tax, to alcohol duties, to capital gains tax. He was Chairman of the Executive Committee of the Society for Individual Freedom, and was the Economic Director of the Confederation of British Industry.

Maxwell Marlow, who has updated the paper, is the Director of Research at the Adam Smith Institute.

The Adam Smith Institute is a free market, neoliberal think tank based in London. It advocates classically liberal public policies to create a richer, freer world.

UK childcare crisis can only be tackled by radical reform

New policy brief sets out vital steps to drive down childcare costs and improve quality

The prohibitive cost of childcare disproportionately hurts women. Women are often financially punished for pursuing a career because the cost of childcare in the UK is the highest in the OECD.

Many women must choose between becoming relatively poorer or putting their career aspirations on hold. But this need not be the case.

Despite the recent Budget announcing an extra £4 billion a year to subsidise childcare, it remains in need of significant reform.

The Adam Smith Institute has compiled the strongest arguments in favour of reforming childcare and complementary policies to bring down costs, provide better quality, and increase parental choice.

A new policy brief from the Adam Smith Institute’s proposes a variety of measures, including:

Ending the £100,000 tax cliff edge.

Easing informal childcare arrangements.

Providing tax credits for work-based creches.

Frontloading Universal Credit payments.

Restructuring the Free Early Education Entitlement Scheme.

Increasing training and qualifications subsidisation.

Sofia Risino, Research Associate at the Adam Smith Institute, said:

“Whilst it is very encouraging to see the Chancellor take steps to adjust our childcare regime, there is still so much to do on the supply side. Simply dumping more cash onto parents solves some issues, but only in the short-run. Changing the cliff-edge, deregulating childminding, going further to encourage work-place creches, and opening accessibility to the Skills Fund are the longer-term solutions that the government should be pursuing.”

Notes to Editors:

For further comments please contact Director of Communications Connor Axiotes on connor@adamsmith.org, or 07584 778207.

The Bank of England’s Failure: baked in inflation is making us all poorer

The Adam Smith Institute on Bank of England rate rises amidst high inflation and excessive Quantitative Easing.

With CPI rising to 10.4%, inflation is more baked in than many imagined. Inflation is most hurtful to the poor and vulnerable in our society, who are least able to afford price rises or renegotiate their pay. The Adam Smith Institute wants to see:

The Bank of England answer for its abject failure in meeting its 2% target and recognition that they were too slow and timid in managing inflation.

Central bankers refocus on the core types of money (such as M1 and M2), which were neglected despite huge spikes, a key cause of current inflation.

Caution against overcompensating now (through excessive rate rises), needlessly risking financial stability, and prompting bank runs, and a recession.

The government helping to counter inflation, with supply side and planning reform - not further boosts to demand that distort the economy and fail to fix the root problems in the UK economy.

CPI rising to 10.4% shows that inflation is more baked in than many imagined. The rise prolongs our cost of living crisis, punishes savers, makes goods increasingly expensive, and encourages public sector strikes as workers seek higher wages to compensate.

Inflation is most hurtful to the poorest in our society - those least able to afford price rises or renegotiate their pay. It is a moral failing of policy and leadership that the most vulnerable take on a disproportionate share of the burden.

We cannot continue to sit idly by and expect the problem to fix itself. The ASI believes there has been an abject failure of monetary policy. Although the Bank of England has independence to make rate decisions, they have materially failed to meet their 2% target. This alone should prompt the resignation of the Governor, Andrew Bailey. However, with Number 10 redirecting flak to external supply side shocks, the Old Lady of Threadneedle Street has been cleared from blame in the press and politics.

Inflation was not a transitory problem, or simply the result of Ukraine and supply shocks, but a failing of central bankers. Monetary policy was too loose in the US and UK, with a huge spike in M2 money supply during Covid. The Federal Reserve and Bank of England were too slow and too timid to raise interest rates.

The Bank of England and its peers have serious questions to answer. Central banks must stop neglecting monetary theory and re-focus on money supply metrics. It is perhaps revealing that the Federal Reserve even discontinued weekly measures of money supply (M1 and M2) in January 2021, just after they spiked and provided a clear warning sign of the inflation which would follow. Likewise, the long-run pumping of M4 (broad money) propped the economy on credit-based stilts, meaning that it remained exposed across all sectors to external shocks.

Worryingly, central bankers now risk over compensating, with rates increasing and therefore monetary policy tightening too aggressively - a key historical cause of self-inflicted bank runs and recessions. One US measure of money supply (DM4) recently declined year-on-year, its largest fall in over a decade, a worrying omen: such declines have been followed by bank runs and recessions in the past Without a proper focus on money supply, the Bank of England risks needlessly damaging financial stability, prompting avoidable bank runs or causing a recession.

Our government can help counter inflation too, by revisiting supply-side and planning reforms. For example, if the UK builds more houses, creates more childcare capacity in nurseries, and rapidly approves and builds more nuclear energy, the price of these goods will come down. Some measures in the recent budget were targeted at the right areas (e.g. childcare), but by focusing on demand not supply, failed to fix the root issues.

END

For further comments, please contact Director of Communications Connor Axiotes on connor@adamsmith.org, or 07584 778207.

Media contact:

emily@adamsmith.org

Media phone: 07584778207

Archive

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- January 2021

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- September 2013

- August 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- April 2008

- March 2008

- February 2008

- November 2007

- October 2007

- September 2007

- May 2007

- April 2007