NEWS

The protectionist commission Adam Smith warned about

Following the Government’s announcement of a Trade and Agricultural Commission our Matt Kilcoyne says:

“In response to the actually unacceptable news of a commission being set up to restrict the scope of trade talks in response to lobbying efforts by the NFU, please find a bit of perfect Adam Smith who dealt with this kind of nonsense in 1776.

‘People of the same trade seldom meet together, even for merriment and diversion, but the conversation ends in a conspiracy against the public, or in some contrivance to raise prices.

‘It is impossible indeed to prevent such meetings, by any law which either could be executed, or would be consistent with liberty and justice. But though the law cannot hinder people of the same trade from sometimes assembling together, it ought to do nothing to facilitate such assemblies; much less to render them necessary.’

This commission is a kick in the teeth for consumers and it is a conspiracy by a powerful few against the public good.”

To arrange an interview or further comment please contact Matt Kilcoyne on 07904099599 or via email matt@adamsmith.org

Lockdown Independence Day is a cause for celebration

Our Matthew Kilcoyne welcomes the Prime Minister’s announcements to reopen the UK economy’s lockdown as the viral threat recedes.

"Britain’s Lockdown Independence Day will be the 4th of July and that is a cause for celebration. While caution has been prudent in the face of a viral threat, we cannot exist in a state of government-imposed stasis forever.

"Common sense solutions previously mooted now need to come into effect: allowing any pub to operate outdoors, use their car parks as beer gardens for punters, and even use local parks as part of their backyard. Cafes and restaurants must be able to turn high streets into living streets with outdoor seating.

"These are the first of many steps the Government should take to ensure that our retail and services sectors thrive. It should come with the withdrawal of support for businesses that can stand on their own feet. But those that still face government restriction on raising revenue deserve support while the virus continues to disrupt our lives."

To arrange an interview or further comment please contac Matt Kilcoyne on 07904099599 or via email matt@adamsmith.org

Govt listens to concerns over NHS app

Head of Research Matthew Lesh welcomes the news that the government is to abandon its home-made app in favour of working with Apple and Google to provide a decentralised contact tracing app with fewer privacy concerns and greater effectiveness:

“We have lost crucial time, but it is welcome that the Government has listened to public concerns to get this important project right. It was always folly for NHSX to try building an app from scratch. Despite assertions, it was never going to work as well or ensure privacy would be protected as the Apple-Google framework. The decentralised, Apple-Google approach will protect privacy, work across borders, limit battery drain, and effectively work in the background. A more effective app will help protect the NHS and save lives as winter approaches.”

To arrange an interview or further comment please contact Matt Kilcoyne on 07904099599 or email matt@adamsmith.org

Pay blood plasma donors for a safe and secure supply

This World Blood Donor Day (14 June, 2020) a new paper — co-published in the United Kingdom by the Adam Smith Institute, the United States by the Niskanen Center, and the Australian Taxpayers Alliance — argues in favour of paying blood plasma donors.

There are significant global shortages of blood plasma used to make plasma therapies. Demand is growing at a rate of 6-10% per year. Three-quarters of people do not have access to the appropriate plasma therapy, largely outside of developed countries.

Shortages are significantly exacerbated by the World Health Organisation’s policy — adopted by the United Kingdom, Australia, New Zealand and some Canadian provinces — to rely exclusively on Voluntary Non-Remunerated Blood Donations (VNRBD).

The United Kingdom currently imports all (100%) of its supply of plasma therapies, Canada four-fifths (84%), Australia half (52%), and New Zealand one-tenth (13%). These countries are too increasingly dependent on imports of plasma therapies from countries that remunerate donors such as the United States and Germany. This inflates the global blood plasma price, making it unaffordable for low to middle income countries.

5% of the world’s population is responsible for more than half of all the plasma collected in the world.

In order to ensure a safe, secure, and sufficient supply of plasma therapies, the United Kingdom, Canada, Australia, and New Zealand should adopt Voluntary Remunerated Plasma Collections (VRPC).

Transfusing the blood plasma of those who have recovered from Covid-19, called convalescent plasma, appears to help against the novel coronavirus.The UK’s National Health Service has already begun trials with recovered Covid-19 patients, including from Health Secretary Matthew Hancock.

However, well meaning bans on paying for blood plasma donations in the 1990s to avoid Creutzfeldt-Jakob disease (CJD) and HIV transmission, has left the UK over-reliant on imports at a time international demand is rising and supply is contracting. A new paper, authored by Georgetown University professor Dr Peter Jaworski, argues this World Blood Donor Day (14th June) that it’s time for donors to be paid for donating blood plasma to ensure a healthy supply.

New uses for plasma therapies, and a reduction in plasma donations during the crisis, will put additional strain on what is already a strained global supply, the report outlines.

In return for a voluntary donation of blood plasma, under a reformed paid system the donor would receive payment — either in the form of cash, or a payment in kind such as time off work, vouchers, or tax credits. By increasing the incentive to donate, donations are expected to substantially increase.

The United States, where donors are paid, is responsible for 70% of the global supply of plasma. Altogether, countries that pay donors (including Germany, Austria, Hungary, and Czechia) account for nearly 90% of the total supply. There is now not a single jurisdiction anywhere in the world that meets its needs exclusively based on non-remunerated plasma collections.

Demand for plasma therapies is growing at around 6-10% per year. Blood plasma is now the USA’s 11th most valuable asset for export, worth US$26 billion and expected to reach US$44.3 billion by 2023.

The report argues that the UK, Canada, New Zealand, and Australia should follow many European countries and the USA in withdrawing prohibitions on voluntary remunerated plasma collections. These developed, English speaking democracies would ensure a domestic security of supply and free themselves from over-reliance on the United States or EU-only schemes.

Stringent viral detection tests required for donations by regulators limit the countries that effective donations can be taken from to reduce risk from blood transmitted diseases such as HIV, HBV, and HCV. Modern procedures including heat treatment, solvent and detergents, and nanofiltration limit this further to developed world countries. However, increasing supply in the UK, New Zealand, Canada and Australia, could have beneficial effects for the developing world too.

Five-percent of the world’s population is responsible for more than half of all the plasma collected in the world. North America and Europe together account for 74% of all immunoglobulin treatments derived from blood plasma used in the world, while Latin America uses just 5%, Middle East and Africa consume just 2%. The UK’s import of plasma therapies means millions of people in the developing world who could be helped by plasma therapies are left to go without.

Due to historic fears over vCJD, the United Kingdom is currently the furthest from the objective of sourcing plasma therapies. All of the country’s plasma therapies are imported, mostly from the United States. “Spontaneous” development of CJD is now, however, comparable in the UK to other developed countries and the over abundance of caution should be removed and paid donations allowed, the think tank argues. This could help meet the near 10% growth per year in demand for plasma therapies.

Peter Jaworski PhD, author of the report:

“Voluntary Remunerated Plasma Collections are the only evidence-based path towards a safe, secure, and sufficient supply of plasma. Relying on non-remunerated donations makes no medical or economic sense. It is at least twice as expensive, and less than half as effective. This is a threat to patients, and a risk to their supply of plasma therapies.”

“The UK, Canada, Australia, and New Zealand are a drain on the global supply of plasma. The only way we can finally begin to contribute to the global supply of plasma is to permit Voluntary Remunerated Plasma Collections at home.”

Nobel Prize winning economist Alvin Roth says of the current over-reliance on the US’ paid donor market:

“I find confusing the position of some countries that compensating domestic plasma donors is immoral, but filling the resulting shortage by purchasing plasma from the U.S. is ok."

John Boyle, President of the Immune Deficiency Foundation (U.S.):

“The global demand for plasma’s life-saving properties continues to grow, so it’s vital that we collectively explore practical ways to increase plasma donations so that supply keeps pace. Because people living with many types of primary immunodeficiencies require lifelong infusions of plasma-derived therapies, our community is especially sensitive to the need for an adequate global plasma supply. We believe that recognizing plasma donors for the heroes that they are and educating the public on the need for more donations is important. We also believe that it’s time the international community looks realistically at the possibility of compensating plasma donors so their most vulnerable community members aren’t forced to go without their medicine because of politics, bias, or misinformation.”

Kate Vander Meer, founder of Plasma for Life (Canada), a patient group:

“At the end of the day, it is patients who bear the biggest risk if there is a safety issue but what is often overlooked is that security of supply is just as essential to patient health. Patients know paid plasma is just as safe. We have been putting it into our bodies for years. It's the negative impacts of shortages, the anxiety over supply, and the guilt of seeing other patients suffering through shortages knowing Canadian patients are a significant drain on the global supply when we should be capable of contributing that weighs heaviest on me.”

Robert Slonim, professor of economics at the University of Sydney, says:

“Professor Jaworski’s brief “Bloody Well Pay Them,” is a must read for all Australian health and blood authorities, and the Australian Red Cross Lifeblood. Jaworski’s sober review of the evidence leaves no room for doubt that Australia’s non-remunerated plasma policy to collect plasma is an unmitigated failure leaving Australia increasingly vulnerable to shortages and health risks that, costing over $1 billion every five years, is unjustifiably and excessively burdensome on Australian citizens. Any fair minded non-dogmatic reader of “Bloody Well Pay Them,” will undoubtedly conclude that Australia should immediately take action towards remunerating plasma donors before the failed non-remunerated policy turns into a national health crisis”

Matthew Lesh, Head of Research at the Adam Smith Institute, says:

“We have a practical need and moral duty to begin remunerating blood plasma donors. Not only would it ensure the safe and secure domestic supplies for life saving treatments, it would also mean contributing to rather than taking away from the global supply.“

Brian Marlow, Executive Director of the Australian Taxpayers Alliance, says:

“Australia’s ongoing policy of non-remuneration for plasma collection is a large part of the reason we have huge shortages and ever increasing public healthcare costs for taxpayers.If adopted, the solutions outlined in this report would help encourage more plasma donations and save the Aussie taxpayer hundreds of millions of dollars over the next few years. I can't think of a better solution.“

Samuel Hammond, Director of poverty and welfare policy at the Niskanen Center, says:

The world's dependency on the United States for blood plasma is unsustainable. It makes health systems in the U.S. and other developed nations more fragile, and reduces access to plasma therapies in many developing nations. The W.H.O.'s opposition to remuneration exacerbates the shortage by standardizing bad policy and perpetuating misinformation about the risks of paid donation. To end the global plasma shortage, our peer countries must end their prohibitions on voluntary, remunerated plasma donation, and shift from a policy of national self-sufficiency to a policy of global contribution.

Notes to editors:

How it works in practice — A unit of raw plasma sells for approximately U.S.$250-300. A unit consists of a litre. The average donation yields roughly 800mL, and is compensated at US$20-50. For a litre of plasma, donors receive between US$30-60. Per litre of plasma, the revenue is split 20-30% for the donor, and 0-5% for the company in the form of profit. Donors receive on average US$20-50, or US$15-35 per hour.

Frequency of donations — the United States permits twice-weekly donations, up to 104 times per year. However, according to data from 2017, the average frequency of donations per 12 months was 21.4, with 14% giving more than 50 times, and 6.7% giving more than 70 times.

For further comments or to arrange an interview, contact Matt Kilcoyne: matt@adamsmith.org | 07904 099599.

The Adam Smith Institute is a free market, neoliberal think tank based in London. It advocates classically liberal public policies to create a richer, freer world.

Revolution required to solve social care crisis

A new paper from the neoliberal think tank the Adam Smith Institute argues that the social care system is broken, unfit for purpose and cannot be fixed by new taxes.

Social care system is characterized by perverse incentives and is woefully out of date.

Taxpayers should pick up the ‘long-tail’ costs of those needing many years of care.

Making social care free to everyone as part of the NHS is a non-starter and would be the largest nationalisation ever.

Debate over the budget for social care is pointless when the money spent goes into a system that is largely dysfunctional.

Public funding and long term care budgets should give much higher priority to younger adults with physical disabilities, mental health or learning problems, whose needs have long been under-resourced.

The UK social care system is broken, unfit for purpose and cannot be fixed by new taxes and spending or making more people eligible for free care, says a new report by the Adam Smith Institute.

While Covid-19 has focused attention on elderly people in care homes, half of social care spending actually goes on younger people with physical, mental health or learning problems, plus help delivered to people’s own homes. The whole system is in crisis, argues the Adam Smith Institute, distorted by perverse incentives, unfair and woefully out of date. While there has been much talk about raising public care spending and providing more free care, it argues, only widespread and disruptive change will solve the deeper problems and prevent future cases of neglect.

The think-tank calls for “disruption” to the system and for “new partnerships in new markets that embrace fundamental change.”

“People aren’t looking beyond how to get more money into social care,” argues the report’s co-author Eamonn Butler. “And more funding is seen as a magic bullet that would solve all the problems. But an arbitrary boost to care budgets will do little good. We can only solve the crisis in social care by looking at and radically reforming the whole system, not just one part of it.”

From 2017 onwards the Government promised a Green Paper, aiming to “ensure that the care and support system is sustainable in the long term” and to improve integration with health and other services and between different care providers. During the 2017 General Election campaign, former Prime Minister Theresa May said the proposals would include a lifetime “absolute limit” on what people pay for social care—though there was less agreement on how this would work, how much it would cost, and how it would be funded. After the 2019 election there was talk of a White Paper, before the Covid-19 outbreak cut discussions short.

Most care homes with residents funded by local authorities are over 20 years old and no longer up to modern standards, the free market think tank argues. Many are converted old hotels and houses, with narrow corridors, small rooms and no en-suite bathrooms. Equally, self-pay residents get a raw deal from providers and insufficient protection from regulators.

Meanwhile, live-in carers hired by families typically have no qualifications and many are paid less than the national living wage. And care delivered free to vulnerable people in their own homes by local authorities is usually selected on price, not quality, and there is very little use of modern information and artificial intelligence technology that could spectacularly raise its quality and efficiency.

“The idea of making social care free to everyone as part of the NHS, possibly funded by a new ‘care tax’, is a non-starter,” says Eamonn Butler, warning that “this would be the largest nationalisation ever. The NHS has 170,000 beds in 1,300 hospitals. Adding another 480,000 beds in around 20,000 nursing and care homes would overwhelm it completely.”

The Institute also thinks it unlikely that the government would stump up the hundreds of millions of pounds needed to upgrade residential homes, or that taxpayers would accept the extra burden. Instead it advocates a partnership with private pension and insurance investors to develop large numbers of new and upgraded facilities, and lease them to local authorities, giving local authorities a long term, whole-service package without having to find the capital to build new homes themselves.

And it says that there are other options, such as individual savings accounts or the Australian system, a mixture of voucher subsidies and refundable bonds, should be explored first before any hasty decisions are made.

On funding, the report’s authors say that insurance is not presently a viable way of people providing for the care they might need later on, because the insurance industry cannot cope with the ‘long tail’ risk—the risk that a few individuals might need a great many years in a residential nursing or care home. In order to create a viable insurance system and induce more families to contribute to their own care needs, the Institute proposes risk-sharing between individuals and government. If people insure themselves for six years’ of residential care, they suggest, the government would pick up anything beyond. This helps ‘pool’ risk and makes insurance affordable.

In return, public funding and long term care budgets should give much higher priority to younger adults with physical disabilities, mental health or learning problems, whose needs have long been under-resourced.

A more rational and affordable care system will involve disrupting the market, but will deliver better supply, sustainability and fairness in a more functional system. Without a radical overhaul of provision, increases in public funding will not avoid future crises.

Andrew Lansley, former Secretary of State for Health (under the Coalition)

“I welcome this further contribution to the debate on how we can sustain social care in the future. I do sincerely hope that this will encourage action now”.

Rt Hon Paul Burstow FRSA, Former Health Minister (under the Coalition)

“As we begin to contemplate the world after Covid the Government must spell out its plans for the renewal of the purpose, workforce and fabric of social care. This report is a timely contribution to thinking about how and what we pay for to secure the right care and support for all who need it.”

David Davis MP, Member of Parliament and former Chairman of the Conservative Party:

“Nationalisation or pseudo nationalisation of the care sector would only compound the mistakes that have led to too many deaths. We need creative solutions to deliver large-scale private sector investment into the system that would improve patient outcomes. If more state control is the answer than someone is asking a pretty dumb question.”

Peter Carter, former Chief Executive of the Royal College of Nursing:

“This interesting paper provides a way forward on one of the most pressing issues facing society across the UK at this time. Social care is under huge pressure and the existing model of funding is not sustainable. I would recommend this paper as a way forward.”

Stephen Collier, Chair of NHS Professionals, Chair of Eden Futures and former Group Chief Executive of BMI Healthcare, says:

“This is an interesting and challenging read. Its proposals on funding of new care home capacity are both imaginative and deliverable, and if implemented would help the sector, and the broader economy at a difficult time. The proposals would help raise standards of accommodation for the care sector and the flow-through effect on service quality would be strongly positive.”

Andrew Lewer MP, Member of Parliament:

“I welcome this Report by the Adam Smith Institute into the future of Social Care. There has been agreement across the political spectrum that wholesale reform of care is necessary for the whole of this century and yet it has not happened. The issue must move from the “too difficult” column to the “too difficult to ignore” column and it must do so urgently. The ideas in this Report provide some well thought through ways forward.”

Stephen Collier, Chair of NHS Professionals, Chair of Eden Futures and former Group Chief Executive of BMI Healthcare:

“This is an interesting and challenging read. Its proposals on funding of new care home capacity are both imaginative and deliverable, and if implemented would help the sector, and the broader economy at a difficult time. The proposals would help raise standards of accommodation for the care sector and the flow-through effect on service quality would be strongly positive.”

Roger Williams CBE, Director, Institute of Hepatology:

“An excellent and balanced account of the present situation and of what might be possible for the future.”

Ian Smith, former Chair, King’s College Hospital Trust and former Group Chief Executive of BMI Healthcare:

“Incisive report.

Clearly the care home and the care at home sectors are under existential threat. I think you have come up with a number of ways that this vital sector can be saved.”

Dr Mary Baker former President of the European Federation of Neurological Associations and former CE of the Parkinson’s Disease Society:

"This well written report offers new ideas for social care that are convincingly thought through and succinctly expressed; a very good and balanced report.”

Jonathan Lord, MP for Woking:

"Congratulations on this excellent report. It’s a very useful contribution to the debate on social care and raises a number of crucial questions that are too often overlooked."

Notes to editors:

For further comments or to arrange an interview, contact Matt Kilcoyne: matt@adamsmith.org | 07904 099599.

The Adam Smith Institute is a free market, neoliberal think tank based in London. It advocates classically liberal public policies to create a richer, freer world.

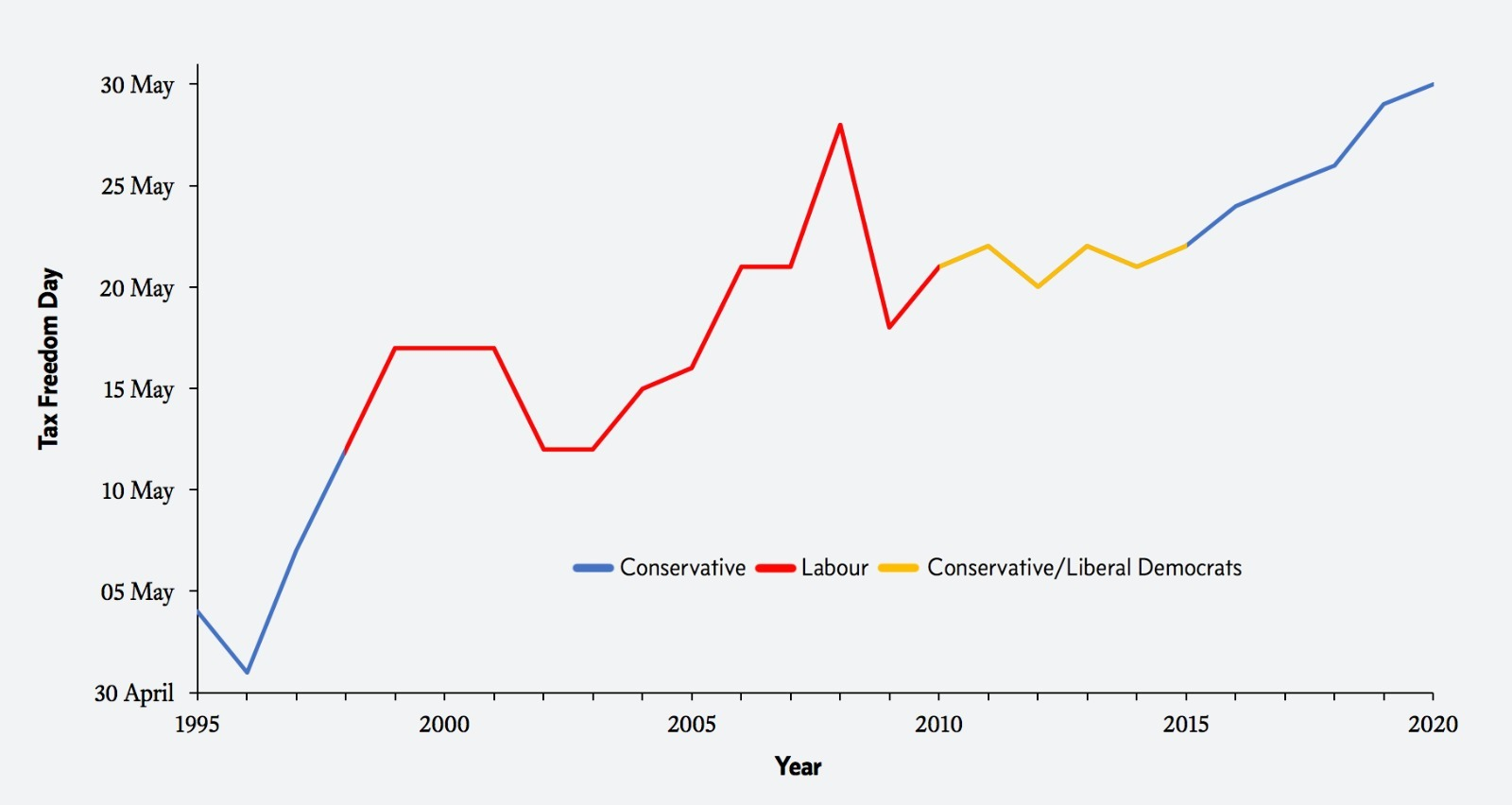

Happy Tax Freedom Day!

As of June 2024, this is out of date. Please refer to Tax Freedom Day 2024 for the updated statistics.

EVEN PRE-COVID TAX BURDEN HIGHER THAN AT ANY TIME SINCE 1995

Taxpayers worked 149 days for the Chancellor this year, today is the first day they start working for themselves

Tax Freedom Day falls on May 30th the latest it's been since 1995

Brits work 149 days of the year solely to pay taxes, 1 day more than last year, but as of today workers are earning for themselves

UK Taxpayers will fork out over £773 billion to the Treasury this year, 41.17% of net national income

But Tax Freedom Day is based on figures from before the economic and fiscal effects of COVID19 and the lockdown came into play

Cost of Government Day, which factors in borrowing as well taxes is the earliest it has been since 2008. The UK is successfully bringing down the deficit, but spending is still too high.

With tax demands at record highs, the way forward for growth at the end of lockdown cannot be to increase the burden on businesses but to reduce tax on the revenue generating private sector

Recent polling showed 72% think that the Government should reduce taxes after the lockdown to try to increase economic growth and jobs, with fewer than one-in-ten (8%) disagreeing with reduced taxes.

Tax Freedom Day is a measure of when Britons stop paying tax and start putting their earnings into their own pocket. For 2020 the Adam Smith Institute has estimated that every penny the average person earned for working up to and including May 29th went to the taxman—from May 30th onwards they are finally earning for themselves.

British taxpayers have worked a gruelling 149 days for the taxpayers this year. More than in any year under New Labour, and one day longer than last year. Britain’s tax burden is moving in the wrong direction.

Government tax choices fall on UK Taxpayers, this year they will fork out £773bn—representing 41.17% of net national income.

Unfortunately for Britons, this Tax Freedom Day cannot yet take into account the tax costs of measures taken to tackle COVID19. All borrowing is a form of taxation deferred and the hundreds of billions of pounds borrowed to tackle this viral threat will only begin to be borne in future years and as the government begins to unlock economic activity.

Tax Freedom Day remains over a month later than in the USA, and the UK has fallen behind Canada where their Tax Freedom day was on May 19 this year.

In April 2020 the Adam Smith Institute commissioned Survation between 15th - 16th April 2020 to undertake a nationally representative online poll of 1,001 UK adults (margin of error +-3.1%) to investigate the financial impact of the lockdown, views on developing an economic recovery and lockdown exit plan, and tax policy after the lockdown.

There is popular support for reducing taxes after the lockdown to help boost the economy and jobs. Younger cohorts are the most supportive of tax cuts after the lockdown. Almost three-quarters of respondents (72%) think that the Government should reduce taxes after the lockdown to try to increase economic growth and jobs, while fewer than one-in-ten (8%) disagree with reducing taxes.

Of those aged 18-34, two-in-five (44%) “strongly support” lower taxes after the lockdown, compared to just one-third (33%) of those over the age of 65.

The Adam Smith Institute singled out tax and regulatory changes in a recent report, Winning the Peace, that would boost growth post-lockdown and the pay packets of Britons right across the country:

The UK Government should respond to dire warnings on unemployment by immediately raising the threshold for employer’s National Insurance to £12,500.

Abolish the Factory Tax, by allowing for the immediate full write off on capital investments, to encourage business investment. ASI estimates show abolishing the factory tax would boost investment by 8.1 percent, and labour productivity by 3.54 percent (£2,214 per worker) in the long-run.

Governments across the UK should abolish stamp duty (in Scotland the Land and Buildings Transaction Tax). Britain’s most damaging tax, Stamp Duty destroys 75p of wealth for every pound raised.

Dr Eamonn Butler, Founder and Director of the Adam Smith Institute, said:

“Borrowing in a crisis is easy, making sure we balance the books and stop passing the buck to the next generation will be the hard bit. An economic recession and even the possibility of a depression cannot be ruled out. There will be calls for grand plans and spending like the clappers, but what we’ll actually need is the economic freedom to make choices for ourselves. We’ve all seen the damage in recent weeks of Whitehall deciding what’s good on our behalf.

“As we remove short-term restrictions we also need to remove the long-run burdens of government on transactions, investment, employment and our access to goods and services. We should not risk turning the last few months we’ve lost into a whole lost decade.”

Notes to editors:

For further comments or to arrange an interview, contact Matt Kilcoyne, Head of Communications, matt@adamsmith.org | 07904099599

The Adam Smith Institute is a free market, neoliberal think tank based in London. It advocates classically liberal public policies to create a richer, freer world.

Raab right to extend visa offer to BNO passport holders

Responding to Dominic Raab’s announcement that the UK will extend visa rights to BNO passport holders if China does not suspend plans for new security laws in Hong Kong, Matt Kilcoyne, Deputy Director of the Adam Smith Institute, said:

“Raab is right to extend the offer of a visa. It will remind China that the UK and the rest of the free world will not sit idly by while inalienable rights, that we legally guarantee, are removed. But let's not delude ourselves, the Chinese Communist Party has no intention of swaying from its course.

”Britain needs now to be preparing to welcome those fleeing the scourge of communism for a new life in liberty and peace. The process of applying, getting a job, and starting that new life should be as easy as possible for as many as possible. All that come should have indefinite leave to remain from the first day of arrival. This is a test of the Prime Minister’s vision of a Global Britain. We welcome our fellow Britons with open arms from the get-go. Does Boris?”

For further comment or to arrange an interview, please contact him on 07904099599 or email matt@adamsmith.org

Slash tax and cut red tape to help Britain bounce back

A new paper from the neoliberal think tank the Adam Smith Institute argues that only boosting growth by cutting taxes and barriers to trade will ensure Britain’s economy bounces back from COVID19

Government is now loosening the public health restrictions that have undermined economic activity through a phased plan. The focus must now turn to how to successfully unfreeze the British economy.

As the lockdown eases, focus must shift from redistributing a shrinking economic pie to expanding the economy by embracing private sector entrepreneurship and innovation, and earned success to get people back to work.

Ongoing welfare should be broad-based and focused on helping individuals, not on bailouts to politically favoured companies.

Extraordinary emergency measures to “freeze” the economy that undermine long-run prosperity must not be allowed to become permanent.

The ASI has produced 30 policies to help boost transactions, investment, employment and access to goods and services

UK Government pandemic measures rightly focused on reducing the level of physical contact between people, while fiscal measures have focused on dialling down and switching off in parts for the duration of this crisis, with the corresponding logic being that when lockdown restrictions end that we can simply “switch the economy back on.” It is hoped that the economy will experience a “V-shape” recession.

The Adam Smith Institute argues that, while this would be ideal, it is by no means guaranteed with the risks of mass firm failure and an economic recession turning into a debt laden depression growing week by week.

This lockdown marks not only the first time countries have actively tried to freeze an economy for a long unplanned period of time, but also the first time trying to unfreeze. This will raise many unforeseen challenges.

The think tank argues that the UK must change attitude from economic lockdown to delivering on future prosperity now. In line with social distancing measures, this will mean withdrawing temporary corporate welfare measures, being flexible and not excessively prescriptive, and supporting people not failing businesses. Ultimately, they argue, it will be economic growth that delivers prosperity.

People who become jobless during a recession find it difficult to find future employment, as their skills and professional networks weaken. Young people, particularly those with higher skills, who enter the workforce during a recession have been found to have lower long-run lower earnings. This is what causes the “scarring” effect of lockdown.

In order to reduce the economic costs to wider society from the effects of the lockdown’s restrictions on private enterprise, the government must look now at how, as restrictions are lifted the government can boost:

Transactions — the ability of private individuals and firms to buy and sell;

Investment — the purchase of goods and services that to enable future growth;

Employment — the ability to enter contacts between employers and an employees; and

Access to goods and services — the availability and the liberty to consume products.

The free market think tanks says that the next stage of the recovery will require a new approach guided by following six principles:

Prosperity: The focus must shift from redistributing a shrinking economic pie to expanding the pie by embracing private sector entrepreneurship and innovation, and earned success to get people back to work.

Temporariness: Extraordinary emergency measures to “freeze” the economy that undermine long-run prosperity must not be allowed to become permanent.

Flexibility: Existing ways of thinking will not suffice, it is necessary to be adaptive to circumstance, pursue industry-specific measures and implement radical policies.

Common sense, not micro-management: The state should not seek to micromanage the reopening of the economy, but rather encourage businesses to adapt to new circumstances.

Supporting people, not businesses: Support should be broad-based and focused on helping individuals, not on bailouts to politically favoured companies.

Accepting failure: The economic structure and businesses must adapt to new circumstances; this will mean accepting some previously viable firms are no longer sustainable.

The free market think tank makes 30 recommendations including scrapping transactions taxes like Stamp Duty to restart the housing market, extending permitted development rights to ensure empty office space is turned into homes in inner city areas, reduced taxes on bringing in capital from overseas, scrapping investment taxes to encourage inward investment in manufacturing to rebalance the UK economy, and allowing Britain’s pubs and cafes to operate in the country’s parks.

With new figures out showing those claiming unemployment benefit has increased to 2.1m even with the furlough scheme, the think tank says employment taxes should be scrapped with the employers’ National Insurance threshold raised to £12,500 (employers currently pay 13.8% on every pound an employee earns over £7,488, with no cap).

While the UK is better placed than many economies with more rigid labour markets and investment environments, recovery is by no means guaranteed. Private enterprises need stronger trading conditions to begin recouping revenue lost during the lockdown and to do this, the authors argue, British enterprises will need a concerted campaign by the government to reduce red tape and slash taxes reducing economic activity.

Matthew Kilcoyne, Deputy Director of Adam Smith Institute and co-author of the paper, says:

“If there’s ever been a moment to be bold, now is that time. British businesses have been held back from generating revenue but have been taking on debt throughout the lockdown. As we remove short-term restrictions we also need to remove the long-run burdens of government on transactions, investment, employment and our access to goods and services. Only by freeing the economy up will Boris be able to ensure that the country bounces back.”

Matthew Lesh, Head of Research at the Adam Smith Institute and co-author of the paper, says:

“The Government must now focus on how to unfreeze the economy and a return to prosperity. This will be no easy task. We have never tried to freeze an economy before in response to a pandemic, and nor have we tried to unfreeze one. To do so successfully will mean unleashing Britain's entrepreneurs and innovators with a radical agenda of tax and red tape cuts.”

Notes to editors:

For further comments or to arrange an interview, contact Matt Kilcoyne: matt@adamsmith.org | 07904 099599.

The Adam Smith Institute is a free market, neoliberal think tank based in London. It advocates classically liberal public policies to create a richer, freer world.

Whither the economists while the economy withers under COVID19 lockdown?

With the release of the details of the make-up of the groups advising the government over the lockdown, it is now clear there is a sincere lack of economic expertise as our financial future teeters on the brink. The Adam Smith Institute’s Matt Kilcoyne calls on the government to engage now with economists:

“SAGE includes epidemiologists, psychologists, statisticians, environmental and adolescent scientists, sociologists, and hygiene experts. It does not, however, include a single macro or micro-economist.

“The lockdown is having a huge impact on our lives and livelihoods. Our wellbeing is intrinsically linked to our economic prosperity. Millions of jobs are on the line. Thousands of businesses are on the verge of collapse.

“It is essential that Government policy is based on a wide array of perspectives — but to exclude mainstream economics is a blindspot of exceptional proportions. It leaves gaps in ideas and solutions at a time when we cannot afford any mistakes to be made.”

For further comment or to arrange an interview, please contact him on 07904099599 or email matt@adamsmith.org

Young hit hardest by lockdown, want tax cuts

The Adam Smith Institute commissioned Survation between 15th - 16th April 2020 to undertake a nationally representative online poll of 1,001 UK adults (margin of error +-3.1%) to investigate the financial impact of the lockdown, views on developing an economic recovery and lockdown exit plan, and tax policy after the lockdown. Five questions relating to the economy and people's personal finances during the lockdown were asked:

During the COVID-19 crisis, the UK government has issued a lockdown which has reduced business activity. To what extent, if at all, are you concerned about the impact of the lockdown on the economy?

Which of the following statements applies to you?

Which of the following statements reflects your view?

To what extent would you support or oppose the UK government developing a plan to reboot the economy and exit the lockdown once medical authorities deem it safe to do so?

To what extent would you support or oppose the UK government reducing taxes after lockdown ends to try and increase economic growth and jobs?

Nine-in-ten (89%) of respondents said they were concerned about the economic impact, compared to just 1-in-10 (9%) who are not.

A growing number of people are feeling the financial impact of the lockdown. Younger cohorts are most affected than older ones. Londoners are more impacted than the rest of the country.

Two-in-five respondents (41%) expressed concern that the lockdown is having a negative personal impact, compared to just over half (52%) who stated that it is having no negative impact.

This reflects an increase over time when compared to other polls, indicating that the economic impact of the crisis is growing over time.

Seven-in-ten (70%) of those over-65 report that the lockdown is not having a negative impact on their finances. In contrast, half of those under the age of 54 (49%) are experiencing a negative financial impact of the lockdown.

There is broad, cross sectional public support for developing an economic recovery plan and lockdown exit plan once medical authorities deem it safe to do so — and there are concerns the Government is not doing enough to develop this plan.

Almost nine-in-ten respondents (86%) expressed support for developing an economic recovery and exit plan, compared to just 2% who disagreed. Conservative voters were the most likely to ‘strongly support’ an economic recovery and exit plan (61%), compared to under half of Labour and Liberal Democrat voters (47%).

More people believe that the UK government has not done enough (42%) to develop an economic recovery and exit plan compared to those who think the Government has done enough (34%). While previous polls have shown that the public is very supportive of the lockdown, this support appears to some extent to be conditional on a broad belief that there needs to be an exit plan to the lockdown.

There is popular support for reducing taxes after the lockdown to help boost the economy and jobs. Younger cohorts are the most supportive of tax cuts after the lockdown. Almost three-quarters of respondents (72%) think that the Government should reduce taxes after the lockdown to try to increase economic growth and jobs, while fewer than one-in-ten (8%) disagree with reducing taxes.

Of those aged 18-34, two-in-five (44%) “strongly support” lower taxes after the lockdown, compared to just one-third (33%) of those over the age of 65.

These results present the need for greater involvement of economic expertise in the Government’s decision making.

The Government should take action to ensure economic expertise is at the forefront of analysis in the same way as scientific analysis as the next steps are planned, the think tank argues and recommends an Economic Advisory Group for Emergencies (EAGE) is set up to advise on the withdrawal of the lockdown and appropriate measures to reboot the economy. This should operate in a similar fashion, with a similar level of regard and in tandem, to the Scientific Advisory Group for Emergencies (SAGE).

The think tank recommends that the EAGE could include monetary policy specialists like the former Bank of England Governor Mervyn King, economists like Paul Ormerod whose work has focused on systemic failure in the economy, or regulatory policy experts like Oxford professor George Yarrow.

The Adam Smith Institute argues that these results show that the public, which has broadly supported the lockdown for clinical reasons, nevertheless is concerned about the economic impact, has growing concerns about their personal financial impact, would love to see a plan developed to reboot the economy and exit the lockdown as when is clinically possible.

Economically the impact of the crisis so far has been borne by the young and the private sector, the think tank argues that the results of this polling suggest that groups recognise it is the private sector that will need to be stimulated and are supportive of tax cuts to boost supportive of tax cuts to boost growth and jobs at the conclusion of the lockdown.

Matt Kilcoyne, Deputy Director of the Adam Smith Institute, said:

"People know that our lockdown is having a huge impact on our economy. They are facing increasing financial hardship, with the young particularly feeling the brunt. And they want an economic recovery and exit plan that includes tax cuts.

"An economic recession seems a certainty, but a depression is avoidable if we develop a plan to get the economy growing again at the end of this lockdown. We need to reduce the cost of business face and the burden of taxation."

Media contact:

emily@adamsmith.org

Media phone: 07584778207

Archive

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- January 2021

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- September 2013

- August 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- April 2008

- March 2008

- February 2008

- November 2007

- October 2007

- September 2007

- May 2007

- April 2007