Regulation by result

Too many regulators are obsessed by process, telling businesses and individuals precisely what they must do. The concern should be with the results, not the process. It is process regulation to require that all motor vehicles be fitted with a particular type of catalytic converter. It is result regulation to specify the maximum output of various pollutants that will be permitted.

The former approach limits the technology to that which is known and approved, whereas the latter leaves space for ingenuity and creativity to devise different ways of achieving the stipulated result.

The UK’s forthcoming departure from the European Union gives us an opportunity to move away from the process regulation which has largely been favoured by the EU, and into result regulation to achieve equivalent outcomes.

The Prime Minister’s Mansion House speech referred to the possibility of the UK, post-Brexit, using other means to secure similar ends. In effect she was saying that the UK will not simply replicate EU rules in future, but will often use different methods to bring about similar intended outcomes.

We want the UK to be a hive of inventiveness and entrepreneurship in future, and one way of encouraging this is to allow creative minds space in which to produce and test new ideas. By specifying the results we want regulations to achieve, we are allowing innovators to experiment with novel and unknown ways of bringing those results about. These new ideas might be more efficient or less costly, and they might help create some of tomorrow’s new jobs.

400-600-600, but what about the people who obey the rules?

Public Health England has decided that we should all be eating on the 400-600-600 plan. 400 calories for breakfast and 50% more for each of lunch and dinner. Quite why all should be gaining more calories from solid food than any journalist has ever done we're not quite sure.

There's a problem here though, some people do actually obey the rules:

Under its new ‘One You’ campaign, launched today, Britons are being encouraged to stick to 400 calories at breakfast, and 600 calories for both lunch and dinner.

Critics branded the daily allowance too low for growing children and close to war rations, but public health experts warned that obesity had now become ‘the norm’ and said most people were eating hundreds of extra calories each day.

Even with the significant decline in energy expended in this modern world 1600 calories a day isn't enough to sustain a healthy life long term.

PHE's underlying point is, well it's a claim at least, that everyone lies about how much they're eating., So, set the limit well under what is healthy, everyone lies, they'll be eating the right amount.

The problem being that not everyone does lie, disobey the rules. Different societies, different cultures, will have differing numbers of scoff laws of course, We'd not expect Italians and Germans to have the same incidence of jaywalking for example. We British tend to have more rule obeyers than many other cultures - perhaps not quite as many as the Germans but still.

Which is where PHE is making their mistake. They're noting that on average we lie, as with on average the population's number of legs is less than two. But knowing the number of legs is of no use to the provision of artificial limbs. So too that some lie is of no use in setting calorie targets. For some to many don't.

There will be those who follow this advice religiously and who therefore damage their health. Which really isn't what PHE should be doing, is it? It's the old grand delusion, treating us as a population to be managed rather than the individual humans we are.

Time for roads to become part of the market economy

Politicians across the political spectrum are committed to cutting back carbon emissions to limit the damage of climate change. Today, the biggest area of disagreement is on how best to do it. Is it through markets or central planning?

The EU auctions off tradable permits to emit. In theory, this should allow market forces to find the most efficient way to cut back on pollution. In reality, few sectors are covered by the European Trading System. In most sectors, reducing emissions is up to each member state. The problem is that in sectors outside the scheme member states swap market forces for direct intervention.

Take my home country of Denmark for example. According to a newly released report, 38% of emission in non-ETS sectors in Denmark comes from transportation. Half of the emissions from transportation comes from passenger cars. It makes sense then to see cars a good starting point if we want to lower emission in the non-ETS sectors.

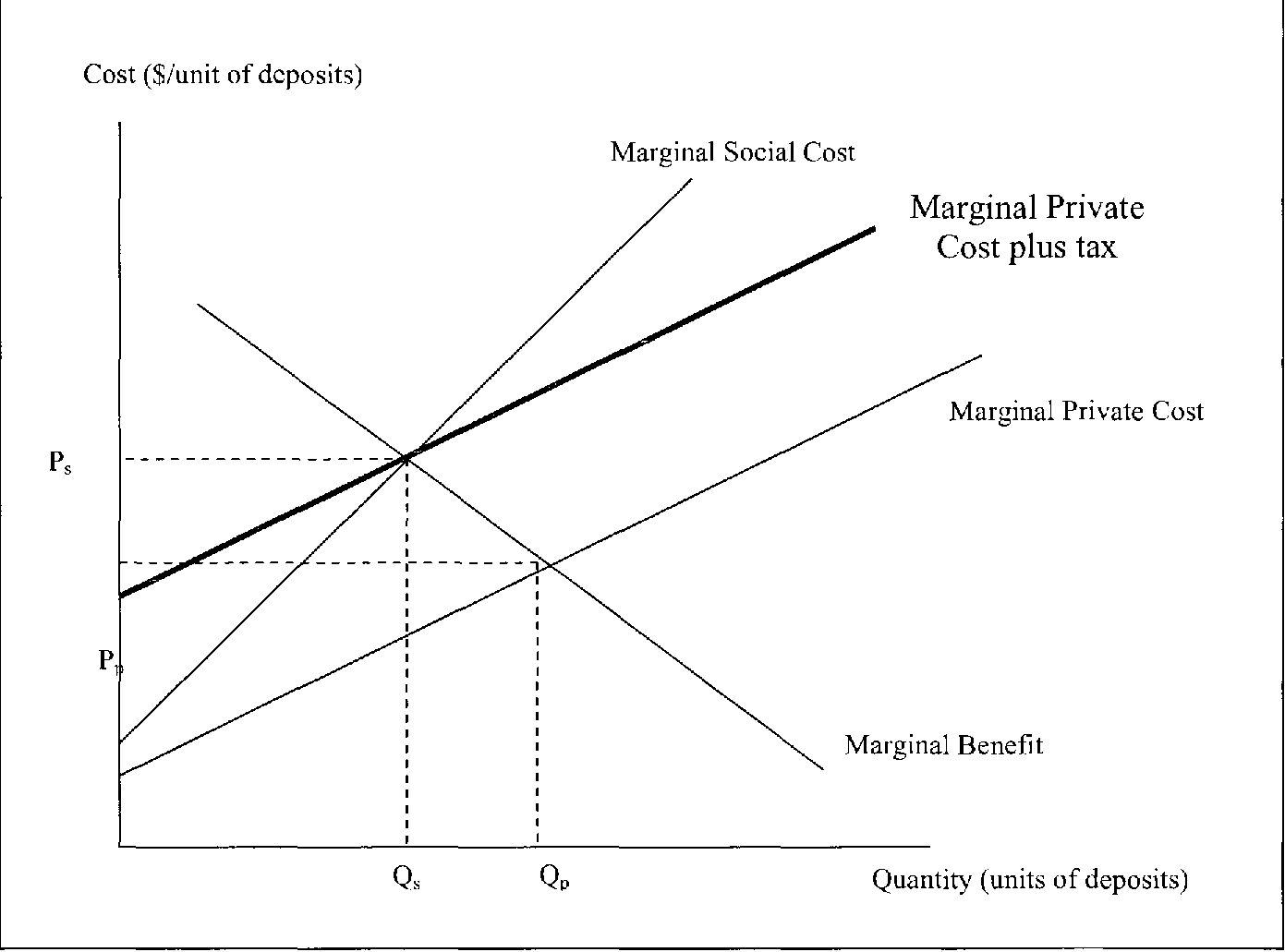

Besides polluting, cars are also noisy, cause congestion and wear and tear the roads. These are all negative externalities or, in other words, costs experienced by third parties. Externalities aren’t included in the price of consumption, so in order to have the consumer and producer take these into account and help limit the external costs encountered by third parties, countries try to put a price on the externality in one way or another. The principle being that you should pay for the cost you cause the rest of society. For example, in a world where externalities aren’t priced, the costs of driving are higher for the society than it is for the motorist. In other words, the motorist have no incentive to take the societal cost into account.

Neoliberals believe, rightly, that taxes shouldn't push morality. They shouldn't distort behaviour into what some think is arbitrarily right Instead, choices should be left to consumers provided they pay the full costs.

Denmark’s approach doesn’t take account of the actions of users but hits all purchasers straight away with high taxes–assuming negative behaviour later down the line. Danes pay a 150% registration tax of their cars and not less than three years ago, they were taxed at 180%. On top of that, there’s a six-monthly ownership tax of between roughly £55 and £2000 and of course VAT of 25%. Unsurprisingly, according to the report published by the Danish Economic Council, taxes on cars are too high. In fact, their calculations show that the taxation of petrol, diesel and electric cars are 120%, 70% and 50% percent higher than the external costs - shocker!

Taxes on passenger cars are therefore concentrated around the purchase and ownership of a car, which in itself doesn’t constitute a negative externality, and not around the externalities they produce. The taxes should therefore shifted to be as close to the source of the externality as possible. Since getting or owning a car is in itself not contributing to pollution or congestion, but the use of your car in peak hours on busy roads is, road pricing is preferable. With road pricing and taxes on fuel motorists can make an enlightened decision based on all the available information about the societal costs. Some will be willing to pay the price while others will find different alternatives. User fees will help cover the costs of maintenance and infrastructure.

As it stands, the focus is not on internalising the externalities. Instead, it has become a question of ideology and being able to say that the Liberal government actually got through with liberal policies instead of handling the real problems. They’ve ended up lowering one tax only to raise another (as it was done last time when the registration tax was lowered). Taxes should have a purpose, to reduce the external costs imposed on society, this approach doesn’t solve that.

Road prices would make people aware of the costs they impose on others. They would then use roads more efficiently. Finding just the right price is difficult, however. The congestion charge in London, for example, was way too low and the price uniform, which meant motorists weren’t nudged towards off-peak hours and routes. A more ideal road pricing scheme would look similar to that of Singapore where they differentiate between time and place. GPS technology, proliferation of smartphones and apps are making it easier and easier to solve the cost issue of road pricing.

There is a pressing need to find a better way of funding roads and cutting emissions. As electric cars become commonplace, fuel duty receipts will shrink. The case for scrapping taxes on purchase and ownership, cutting taxes on fuel and instating road pricing will become irresistible.

We've come a long way from the days of pure socialism on parts of the continent, when prices were ignored in favour of ideology. Yet some hangovers remain. It’s been proven time after time that prices are the best way of allocating scarce resources. When a resource is free to use, it becomes overused because the consumer has no incentive to economise. It’s therefore high time roads become a part of the market economy as well.

We agree with the IPPR, let's abolish corporation tax

IPPR describe themselves as a progressive think tank which is why it's so wonderful to see them proposing a properly progressive idea - let's abolish corporation tax. This isn't, of course, what they think they are suggesting but it is that very thing. For they insist that all sources of income should be taxed at the same rate. Which means that, if dividends are to be taxed at normal income tax rates, we must not tax those same dividends at the level of the company.

The rates and allowances for employee NICs and income tax should be

combined into a single tax schedule, and applied to all incomes on an

individual, annual basis. All income would be treated under the same rates,

irrespective of whether it was sourced from labour earnings, savings, trusts,

dividends or property rents.

We're most certainly not averse to a merger of NI and income tax. We'd insist that when it does happen that employers' NI must be included - just so that all can see how not a low tax nation we are.

That still leaves that dividends point. Currently corporate profits pay corporation tax, dividends being paid out of that post-tax income. Whether tax is collected at the corporate or personal level is a second order consideration, we'd prefer, as here, at the personal. The current system deliberately reflects this reality, that's why there are those lower dividend tax rates at the personal level. So, we abolish those, tax as income purely and simply.

Therefore we must abolish the taxation at the corporate level, abolish that corporation tax charge. As we've been saying we should anyway for a long time now but it's nice to have progressives like the IPPR on board as well.

Alternatively, of course, they've just not understood their own proposal something which, frankly, wouldn't surprise either.

Yes, really, we should have a carbon tax

In fact, we should have had a carbon tax some time ago. This is not to say that all of the extreme predictions of the catastrophists are true. Rather, we know that the fools are going to do something here so let's do the one thing that would actually work. The proof of the carbon tax being:

Successive ministers and officials have kicked the issue of how to decarbonise heating down the road.

That’s partly because it has not yet become entirely clear which technological approach is best, be it electrification of heating, the use of greener gases such as hydrogen, district heating schemes, or some combination of all three.

We face uncertainty here, that proper, Knightian, uncertainty. This is not something where we can play the percentages nor the probabilities, we really just don't know. And we'll not know for some time therefore it is impossible to plan.

So, what should we do? Note that this isn't to agree that something must be done - we know that something will so that's what we're trying to influence. And if something is to be done in the face of this uncertainty, what is it?

We should get prices right - that's the carbon tax - and then sit back and see what happens. For once we have got prices right we can and should, as Hayek so often pointed out, use that great calculating machine of a market economy to tell us what the answer is.

As is so often true there are things just too important for us not to be using prices in markets to tell us what we should be doing.

Living Freedom Conference 2018

Some of our readers might be interested in the Living Freedom conference organized by the Academy of Ideas. It's a 3-day school for 18-25 year-olds to be held from 6pm on Thursday 6th April to 7pm on Saturday 8th April.

"Taking place at the CIEE Global Institute in central London over the course of three days (with hostel accommodation provided to all attendees for two nights), Living Freedom provides a stimulating forum for around 40 young advocates of freedom to attend expert talks and participate in meaningful debates."

Applications must be in by the end of the day on Monday 5th April, so anyone interested should hurry! Click here to find out more!

We thoroughly approve of passports for sale - very Georgist

This story is, predictably, causing outrage. The very idea that rich people should be able to just rock up and buy a passport, citizenship, just for mere filthy lucre. We think it's an absolutely marvellous idea:

The Russian oligarch Oleg Deripaska has bought a Cypriot passport under a controversial scheme that allows rich investors to acquire citizenship and visa-free access to the European Union, the Guardian can reveal.

Deripaska, an aluminium magnate with connections to Donald Trump’s former campaign manager Paul Manafort, is one of hundreds of wealthy individuals who have applied for Cypriot nationality. His application was approved last year.

The revelations will revive concern about oligarchs with Kremlin connections buying EU passports. Large numbers of the Russian and Ukrainian elite featured last year in a list of hundreds of people granted Cypriot citizenship over the past four years.

There is the obvious point that this enables freedom through exit. However robber baron or worse the Russian state becomes those who can flee are free of it. This neatly reducing the incentive for the state to dispossess of course, to the benefit of those who do not so flee.

But also consider the more subtle Georgist point. The value of land depends hugely upon what the surrounding society has built to increase said land value. That's the argument for taxing land values and it's a good one. The value of citizenship is the value that surrounding society has built. A good society, created by those little platoons over the centuries, produces a greater citizenship value than a not good society. We can see this in the migration rates in and out of certain countries, values do differ.

So, yes, just as with land value taxation, society should tax back the value society has created. It's not just that we could sell citizenship, it's that we ought to.

OK, perhaps be a tad more selective over who may buy it but the basic concept is sound.

Chewing gum tax - both a good and bad idea

The idea of imposing a tax upon chewing gum has its merits - there is a cost associated with it after all:

A chewing gum tax should be introduced to help pay to clean up British streets, the Local Government Association has said.

A cross party motion has been tabled in Parliament along with a petition asking Government to crack down on the "nuisance and unsightly blight imposed throughout the UK by the careless disposal of chewing gum".

Local councils currently spend £60 million a year scraping an estimated two million pieces of gum, dropped daily, from pavements.

The campaign is being backed by the LGA and campaigners Clean Up Britain, which has also called for the chewing gum industry to belegally forced to contribute towards paying for the problem.Chewing gum is the second most commonly dropped litter after cigarette butts.

The petition says: "The Government must hold billionaire gum producers accountable for the huge costs their product inflicts. Currently they pay nothing towards these costs.

Standard theory says it's just fine to impose a Pigou Tax where there are third party costs.

However, there are a number of things wrong with the idea too. Firstly, such taxes should not be hypothecated - the revenue doesn't go to trying to clean up the mess. Rather, we're trying to alter market prices so that those imposing the costs have them included in the decisions to act or not.

That leading to the second problem - it's not the manufacturers either imposing these costs nor is it them we'd like to carry them. The costs are imposed by those who spit the stuff out onto pavements. Those are therefore the people we'd like to be paying the costs.

That is, a proper examination shows that we'd like to have a "spitting chewing gum onto the pavement" tax rather than one supposedly upon manufacturers. As it happens, we do already have taxes and fines for littering. We thus just need to enforce current law, not have a new charge.

The idea is thus just fine in that third party cost impositions should be carried by those who impose them. But we do have to correctly identify the actors and then direct our impositions at them. It's people spitting the gum imposing the costs - fine them.

If fascism can't happen then is it still a democracy?

If it's not possible for a country to become fascist then is that place still a democracy? Not that we think there will be a sufficient popular upsurge for that form of government but then we think that about communism and socialism too. And that's rather the point of the surmise:

My argument is pretty simple: American fascism cannot happen anymore because the American government is so large and unwieldy. It is simply too hard for the fascists, or for that matter other radical groups, to seize control of. No matter who is elected, the fascists cannot control the bureaucracy, they cannot control all the branches of American government, they cannot control the judiciary, they cannot control semi-independent institutions such as the Federal Reserve, and they cannot control what is sometimes called “the deep state.” The net result is they simply can’t control enough of the modern state to steer it in a fascist direction.

This is, as stated, true of any radical group. And radical can be pretty milquetoast as well. Certainly Nigel Farage and his compadres have been described as such for wishing to over turn the EU order.

Our point being that we do have a reasonable and workable definition of democracy - can we throw the bastards out? And if we can't then we're not. What Tyler Cowen above is insisting is that we can't throw that deep state out - so, are we still a democracy?

On St David's Day, a look back and a look forward to a better Wales

Today is Wales’ national day. I personally remember it being a day where you dressed up in itchy woolen trousers, a miniature waistcoat and a flat cap. Oh yes, and it was all topped off with a daffodil or leek tied to my lapel that was about half the size of me. We would then spend the entire day sat in a cold hall in a border village getting prizes for handwriting and reciting poetry in a language not one of us spoke.

Nowadays I see it more as a chance to take a look back at my homeland and wish better times lay ahead for the country. Wales has languished at the bottom of the UK league tables for decades now in education, productivity, incomes, and health. It’s depressing. It needn’t be this way.

Wales was once a by-word for capitalist ambition. The Coal and Shipping Exchange, in Cardiff Bay, was completed in 1886 by Edwin Seward as Cardiff became the busiest coal port in the world. The centre saw 10,000 people per day at its height walk through the building, conducting trade negotiations for coal from the South Wales Valleys to be sent across the world. In 1904 the building saw the first ever £1,000,000 contract signed.

A lot of time is spent in political debate in Wales on the effect of privatisation, the effect of reduction in state subsidies and the impact changing demographics and industries has had on Welsh communities. But little is ever mentioned about the impact of nationalisation on the private sector in Wales. The companies that brokers and traders at the Coal Exchange were negotiating on behalf of were privately owned until nationalisation of coal mining in 1947.

The private ownership of companies, and the market reflection of prices resulted in much more elastic labour markets. Between 1851 and 1911, some 366,000 people moved into the South Wales’ coal mining areas. The peak of this migration occurred at the height of Wales’ production power between 1901 and 1911 when 129,000 people moved into the area. These were heavily international areas, with migrants not just from Wales (and large numbers from England, Scotland and Ireland) but also from Spain, Italy, Russians, Poles and French moving to the site of an economic boom. Oddly enough migration brought wealth, vibrancy and a sense of opportunity to locals as well as to newcomers, there were few calls to restrict the flow of labour back in the late nineteenth and early twentieth centuries.

But resource booms that can’t compete with new entrants on the world stage also faced busts. Between 1919 to 1939, after the First World War, there was mass unemployment. Fewer jobs and price responsive mines meant 500,000 people left the valley communities during the interwar years. The Rhondda saw around 36% of its population leave between 1921 and 1951.

Nationalisation stymied the flow, with security cited as part of the reason why taxpayers from across the UK should subsidise loss-making mines and industries. It saw control move from private owners to Whitehall and the costs of extraction and contract fulfillment moved to the general taxpayer. Oddly enough political pressure kept subsidies flowing for decades and the final curtailment (under Wilson and then Thatcher) meant a heavier and more sustained negative shock to the economies of these regions. Public ownership meant also that what was profitable didn’t even stay in the area or provide dividends to shareholders. Government, not shareholders, determined what was the priority and government often chooses losers. It shouldn’t be of any surprise that productivity and GDP per capita is lower in Wales now than in the rest of the UK.

To this day Wales has an over-reliance on public sector employment. 27.6% of the Welsh workforce is employed by the state or in state-owned industries and there is little move by the dominant Labour party to reduce the tax burden, to increase property or share ownership and get Wales back on the rise.

What is positive though is that people are once again on the move. Wales’ productivity now relies on city growth and places like Cardiff, Swansea and Wrexham are making overtures towards building homes and reducing prices to make it profitable to set up or move businesses to them. Cardiff aims to get 11,000 new homes in the city by 2022, with 41,000 new dwellings built by 2026. It will need them, with population growth of 1.2% per annum. What it needs is proactive planners and a national framework that reduces costs. Sadly, ever increasing burdensome regulation is something that the Welsh devolved government is good at.

Welsh housebuilder Redrow found that the average cost of building a home in Wales as opposed to England (once land costs were removed) was over £4000 more due to increased regulation. Rather than avoiding Help to Buy’s subsidy effect on demand, the Welsh government copied Westminster. Sam Bowman, said of the scheme at the English level that it was like “throwing petrol onto a bonfire” and that “supply is so tightly constrained by planning rules, and adding more demand without improving the supply of houses just raises house prices and makes homes more unaffordable for people who don't qualify for the Help to Buy subsidy.”

Wales’ proposed vacant land tax for properties with permission will just mean fewer applications for permission. As my colleague Sam Dumitriu has argued before permissions are mostly underused because of the way that delays or political risk mean chances of getting future approvals are unpredictable.

What Cardiff should be aiming for is a reduction in tax (income and business rates), a simplification of the planning system, and a promotion of inward migration. Wales could benefit from greater agglomeration. Cardiff certainly has the ambition to build homes, attract new businesses, and support the growth of connected urban public transportation. What it now needs is joined up thinking in the Senedd to match it.

Dydd Gŵyl Dewi Sant hapus i bawb!

A Happy St David’s Day to you all!